- Home

- Results & Studies

- The French market for AVoD and FAST: five key takeaways from the AVoD Market Report survey

The French market for AVoD and FAST: five key takeaways from the AVoD Market Report survey

In July, NPA Conseil and Médiamétrie published the 2nd part of the AVoD Market Report survey, which is dedicated to the organisation of the market in France. NPA Conseil launched this three-part survey in late 2022 in order to monitor the development of the AVoD, FAST and more generally CTV ecosystems, throughout 2023. It capitalises on the strategic monitoring of Médiamétrie and NPA Conseil and on the insights from their reference studies, but also on interviews with key players in the market (nearly 70 structures met to date).

The survey highlights five key points in particular:

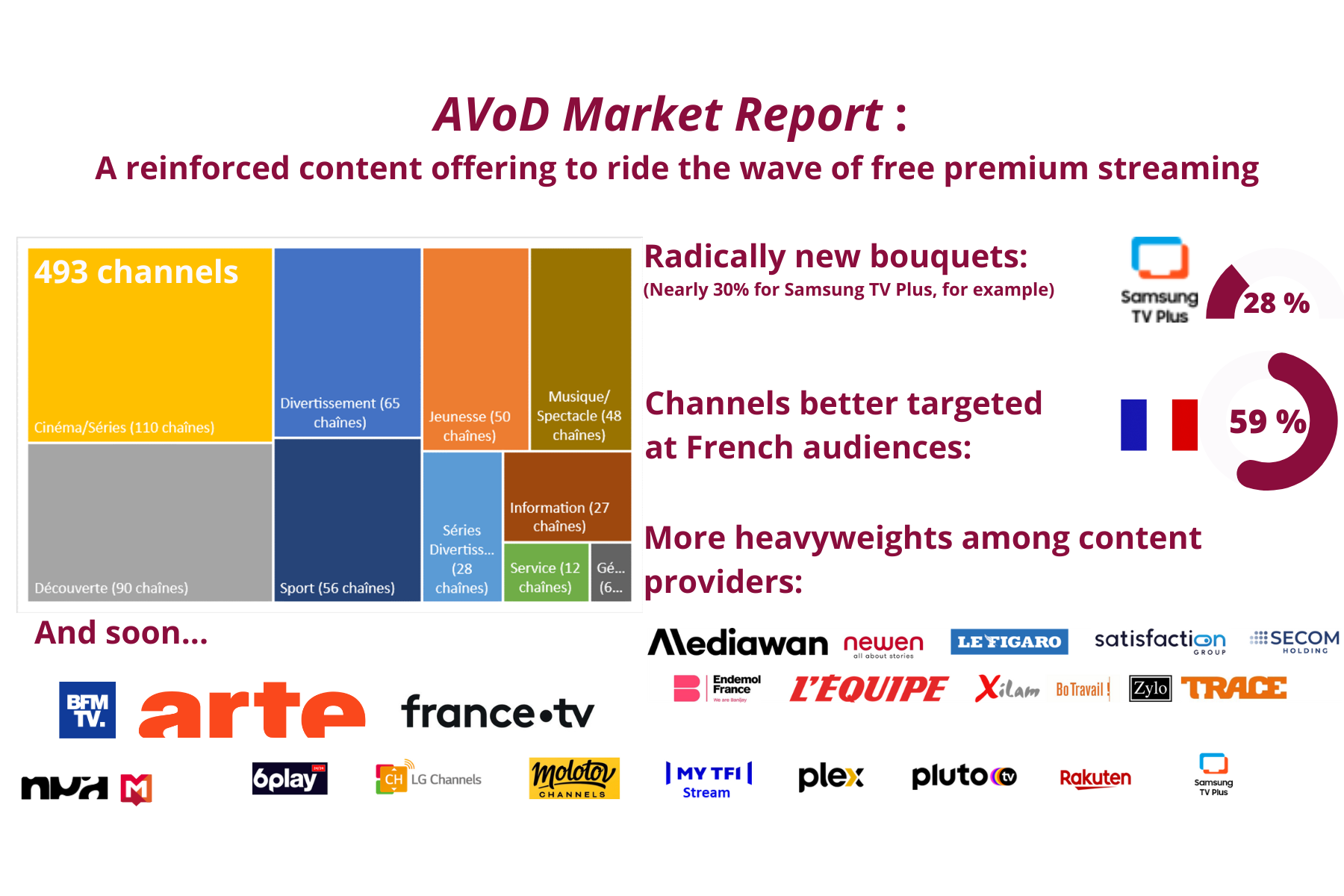

- This offer has become premium, integrating mainly regionalised content, channels more suited to French audiences and published by leading rights holders, while awaiting the upcoming arrival of key DTT players (Altice, France Télévisions, ARTE);

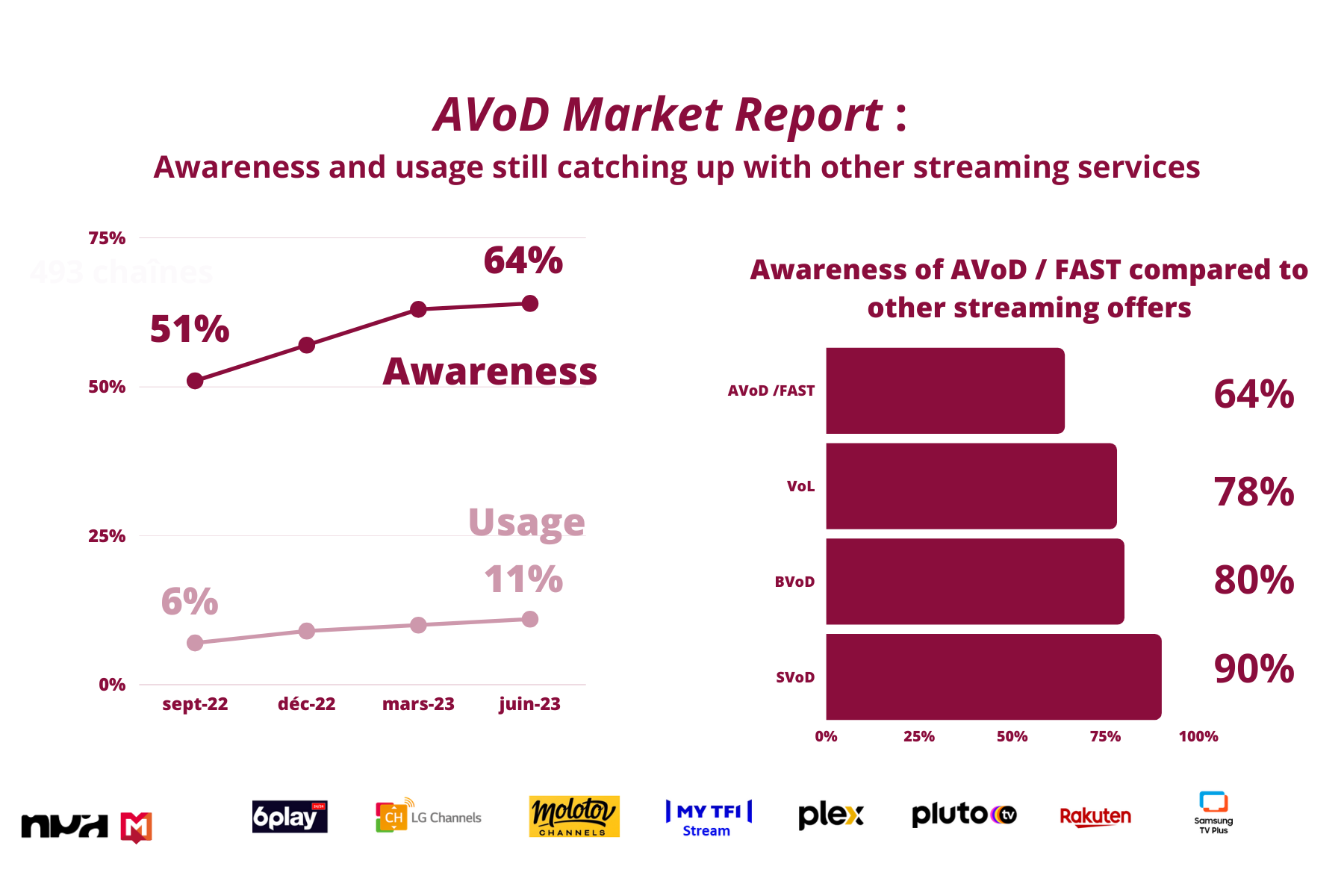

- A strongly growing reputation and usage which has doubled in the space of one season, but a challenge which persists on the distribution side, and the entry of AVoD and FAST into the offers of French operators;

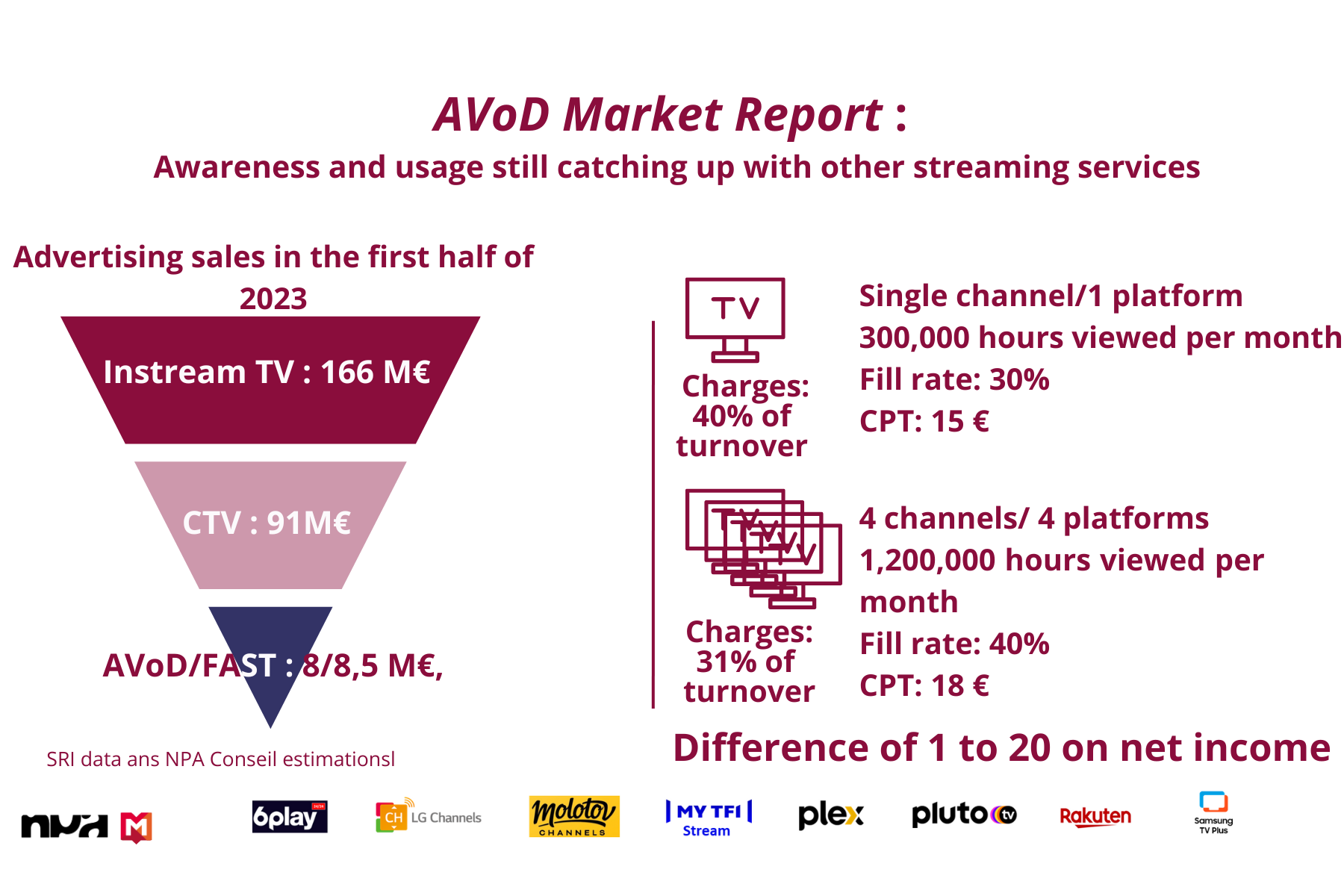

- An advertising market of just under 10% of total CTV still largely dominated by YouTube in the first half of 2023;

- A still very modest promise of income for publishers who focus on a single channel, and costs (particularly technical costs) which can represent 40% of the income generated;

- Varied partnership models between FAST channel publishers and distribution platforms, between a return to the “dry” transfer of rights, similar to the cabsat model and sharing of inventories and revenues for a channel provided by the publisher, which initially made the FAST model specific.

A renewed and “premium” offer

For FAST platforms operating on the French market (Pluto TV, Samsung TV Plus, Rakuten TV and Molotov Channels), qualitative reinforcement took precedence over the quantitative approach during the spring, and the line-ups were significantly renewed (nearly 30% in six months, for example, for Samsung TV Plus).

The move towards premiumisation was reflected in the rise in the range of channels broadcast in French and specifically designed for French audiences (almost 90% today for the leaders Pluto TV and Samsung TV Plus), as well as in the arrival of new key players in the French audiovisual landscape (Newen, Satisfaction, etc.).

If we take into account the 77 different publishers for the 292 FAST channels broadcast in French, eighteen of these alone account for 80% of the offer:

- Producers such as Endemol/Banijay, Bo Travail, Newen, Satisfaction or Xilam, etc.

- Publishers like Euronews, L’Equipe, Secom or Trace TV, etc.

- Or specialist aggregators, such as Zylo and Fast Media.

Mediawan is currently the leading provider of the FAST channel offering in France, with 15 channels built around programme brands belonging to the Group (Baywatch, Captain Sharif, Les filles d’à côté, Toute une histoire, etc.), whether it publishes them directly (a third party) or whether it has sold the rights to Samsung TV Plus or Pluto TV.

On the other hand, some “pioneers” whose offer no longer corresponds today to the standards sought, are losing their place on the platforms, such as Alchimie, which will cease its FAST channel aggregator activities by the end of October.

Increasing uses which are still subject to wider distribution

Over the course of one season (June 2023 vs September 2022), awareness of AVoD and FAST gained 13 points among all those aged 15 and over[1], with a peak of 69% among 35/49 year olds, and use (watching programmes at least once in the past month) almost doubled (x2.5 for 25/34 year olds). AVoD and FAST are benefiting in particular from the ever-increasing number of smart TVs (54% of French households had one at the end of the first half of the year1).

But continuing to develop support requires integrating the offers of internet service providers, especially in France, given the influence they have there. In Europe, several key operators (Deutsche Telekom, Virgin Media, Vodafone and Orange in Spain) have undertaken this integration. According to information collected in the AVoD Market Report survey, at least one of the French leaders (Bouygues Telecom, Free, Orange or SFR) should follow suit before the end of 2023.

Monetisation: uncertain profitability for a single channel and single platform publisher

For 2022, NPA Conseil estimates the turnover generated by all AVoD services and FAST channels in France at €15 million, i.e. three times more than in 2021 (€5 million), and approximately 5% of all instream TV (€296.7 million according to the SRI e-Pub Observatory[1]).

Based on a stable market share, we can estimate revenues for the first half of 2023 to be around €8 million to €8.5 million.

As established by the business plan simulations carried out in the AVoD Market Report survey, the revenue prospects are limited for a publisher operating only one channel, and on one platform, and such publishers may have difficulty balancing the costs associated with the activity (programming, design, self-promotion, play out production, advertising management distribution cost) which can represent 40% of the invoiced amounts.

This leads rights holders to pursue varying strategies:

- Returning to the traditional rights sales business, with prices which approach those of the market for cabsat channels, by negotiating an MG or flat fee to be granted a powerful right intended for the creation of a single IP channel over which the platform has complete control.

- Including the development of AVoD and FAST in a more structuring project, including a package of 3 to 4 channels, ensuring their wide distribution to optimise the monetisable audience, gain expertise in inserting advertising with the help of technical integrators (in particular the French market leaders Amagi and OKAST).

Achieving growth rates above 20% for the entire market, as seen in the most dynamic markets (United States, United Kingdom, Germany, etc.), will require platforms to strengthen their sales teams (seldom more than 3 or 4 people so far) n order to improve fill rates, but also to go beyond the contextual and/or socio-demographic targeting that takes precedence today, in order to better defend the value of CPM. This did not increase significantly in early 2023 and is still around €15 on average.

[1] NPA Conseil / Harris Interactive OTT Barometer

[2] Instream TV combines segmented TV advertising (TVS), advertising revenue from catch-up platforms, through operator boxes and CTV, including AVoD and FAST.

Please click on the icon to download the comprehensive press release.

Download

Test of significance of the differences between two proportions

Used to assess whether the difference between 2 proportions is significant at the 95% threshold

Warning: only applies to a proportion. The Average Rate is an average of proportions and the Audience Share a ratio of proportions. This tool is provided for information purposes. It cannot be applied for professional purposes without further precautions.

des médias

edition

definitions