- Home

- Results & Studies

- AVoD / FAST: the west wind has already taken the market beyond the €250M mark in 2022 in the EU5

AVoD / FAST: the west wind has already taken the market beyond the €250M mark in 2022 in the EU5

It was in the United States that AVoD and FASTs began to develop, with the creation of Pluto TV, back in 2014. In 2022, the 20 platforms counted by NPA Conseil and Médiamétrie in this country and the 1,600 channels they distribute cumulated more than 2% of the total video audience there and about $4 billion in advertising revenue, which represents nearly 20% of the total CTV market.

Over 2200 FAST channels in the EU5

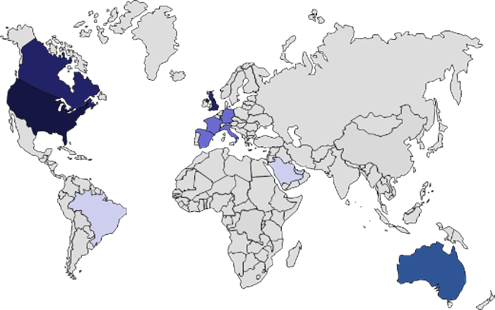

But Latin America, the Middle East, Australia and even more so the EU5 (France, Germany, Italy, Spain and the UK) are following in its footsteps. In the EU5, and on the pan-European platforms Plex, Pluto TV, Rakuten TV, Rlaxx TV, Samsung TV Plus and Xumo alone, the AVoD/FAST Market Report study counted more than 2,200 channels, about half of them exclusive to each national market.

While the quantitative expansion of the offer seems likely to slow down, the premiumization strategy asserted by the platforms and the growing involvement of leading producers and distributors (Banijay, ITV Studios, Fremantle, Newen, Warner Bros Discovery, etc.) will contribute to its qualitative reinforcement and to the dynamics of use.

The multiplication of agreements with historical operators (Deutsche Telekom, Orange España, Talk Talk with Netgem, Vodafone...) or with virtual distributors (Molotov TV, Waipu, Zattoo...) will also stimulate the latter, and will allow to improve their monetization.

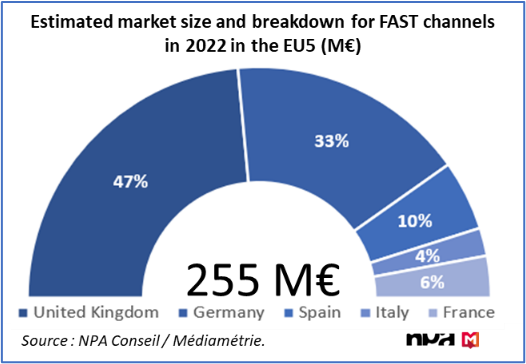

255 M€ of advertising revenues, i.e. 10% of total CTV revenues

In 2022, NPA Conseil and Médiamétrie estimate that AVoD and FAST advertising revenues will reach €255 million in the EU5. To date, the United Kingdom and Germany account for 80%, but the rise in Spain, France and, to a lesser extent, Italy should begin to rebalance the market by 2023. In France, for example, AVoD and FAST still account for only 8% of the CTV market, two points less than the average for the five EU5 countries and ten points less than in the US.

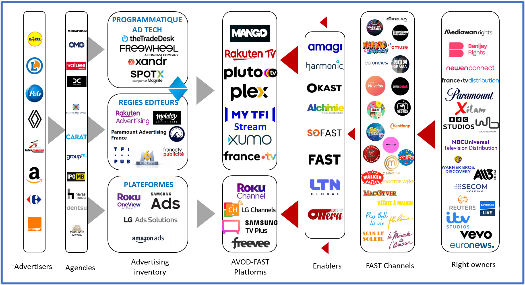

But convincing advertisers and their agencies to increase the share of investment allocated to AVoD and FAST will require clarification of a value chain that is fairly muddled today, and in particular of the organization of their sales.

This will require even more improvement in audience measurement and the qualification of user profiles on these new platforms. “With AVoD and FAST, we'd like to be able to do hyper-segmentation, but the data isn't there yet, and we lack the information to reconcile the different AVoD/FAST, BVoD and YouTube universes," laments one of the forty-five

stakeholders met by NPA Conseil and Médiamétrie for the AVoD/FAST Market Report study. “We can't measure repetition, neither unique Reach, we can't predict capping. So we make approximations”.

"The unified measurement we are working on for 2024 will provide a global vision of all uses, for all video environments, on all screens" explains Laurence Deléchapt, TV & Cross Media Director of Médiamétrie.

All of these elements are studied in part 1 of the AVoD/FAST Market Report, now available. It includes a 76-page main report in Powerpoint format, and an 8-page appendix in Word format.

"The second part of the AVoD/FAST Market Report, which will be published at the end of June, will provide further insight into the ability of AVoD and FAST to address other key issues, such as the optimization of distribution, the sharing of value between channels, platforms and enablers, the ability of leading broadcasters to invest in this new environment, and legal issues related to the status of services or the control of rights," adds Philippe Bailly, President of NPA Conseil.

Please click on the icon to download the comprehensive press release.

Download

Test of significance of the differences between two proportions

Used to assess whether the difference between 2 proportions is significant at the 95% threshold

Warning: only applies to a proportion. The Average Rate is an average of proportions and the Audience Share a ratio of proportions. This tool is provided for information purposes. It cannot be applied for professional purposes without further precautions.

des médias

edition

definitions