- Home

- Results & Studies

- Behavioural Targets: What sites do geeks, podcast fans and “organic-receptive customers” surf?

Behavioural Targets: What sites do geeks, podcast fans and “organic-receptive customers” surf?

How do we reach these customers and potential customers online? Although traditional socio-demographic targets are still extensively used, nowadays, behavioural targets satisfy many of the needs of advertisers. Selections chosen using the Targets+ study. |

Women aged 25-49 are the most frequently researched target group in digital campaigns (observation based on 4,000 measured campaigns by Nielsen Digital Ad Ratings). However, ranging from a self-employed 25 year-old who has gone organic to an employed woman aged 49 who intends to buy a property, this target group encompasses a vast array of profile, consumption and attitude realities to inspire advertisers...

Once a web user has been described using their interests, buying intentions and favourite brands, they become more meaningful than their socio-demographic profile: targeting an individual through their offline behaviour can be an effective way to reach web users who will then be receptive to the campaign. This is the objective of the 2018 edition of Targets+, which crosses the automatic browsing measurement data of 30,000 panellists with their reported behaviours to deliver audiences and affinity indexes for 6,000 websites and 700 apps across nearly 2,000 behavioural targets.

Some browsing behaviours are logical, predictable and ideal for contextual targeting. As such, the website category in which web users with an “interest in cars / motorbikes” are most over-represented in terms of time spent* is Car Info and Classified Ads (time spent affinity index: 180). The leading category for Travel enthusiasts is Cruises (time spent affinity index: 173) and for reading fans, it is Books (time spent affinity index: 135).

* Time spent affinity index: ratio of the target’s proportion of total time spent on the website to the target’s proportion of total internet time. For example, for an affinity index of 180: the weighting of car / motorbike fans in time spent on the “Info and Classified Ads” category is 1.8 times greater than their proportion of time spent on Total Internet.

Some browsing patterns are more unexpected. Indeed, the category where computer enthusiasts are most over-represented is online stock market trading, where “geeks” make up 38.5% of the audience (vs. their 26.8% of the population of internet users).

Turning to news websites and apps, some affinity scores can represent valuable data for audience development: for example, individuals intending to buy Shares / Bonds / Unit Trusts have a time spent affinity index of 205; online car buyers: 140; and online shoppers for luxury accessories: 183. Did you know that the latter group often tune into Franceinfo and BFMTV, and that they read Paris Match and Le Monde?

Affinity targeting: 3 case studies

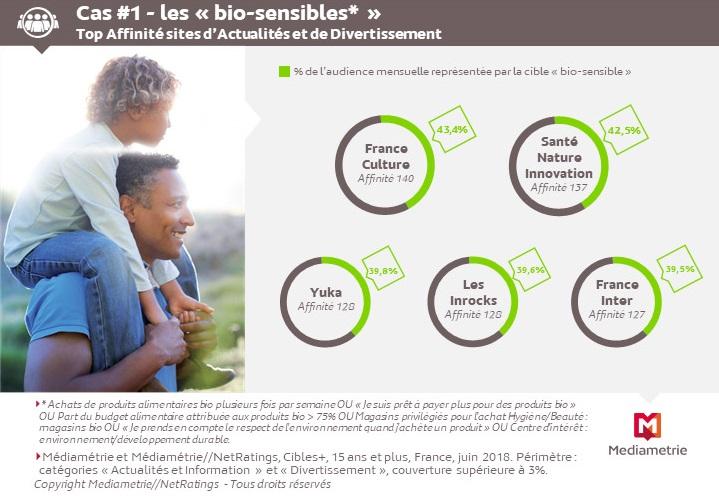

Case Study No. 1 – An advertiser wants to announce his eco-friendly message to environmentally aware web users. Although websites that specialise in the environment would logically be included in the campaign, affinity targeting gives another approach:

Case Study No. 2 – Podcasts are on trend. From traditional audio-visual publishers to the new pure players (Binge, Louie Audio, Boxsons, Nouvelles Ecoutes, House of Podcast, Majelan), with the press and advertising sales houses in between, the audio market is trying hard to expand, create loyalty among and monetise these new audiences. Where do fans of this booming audio format browse the internet?

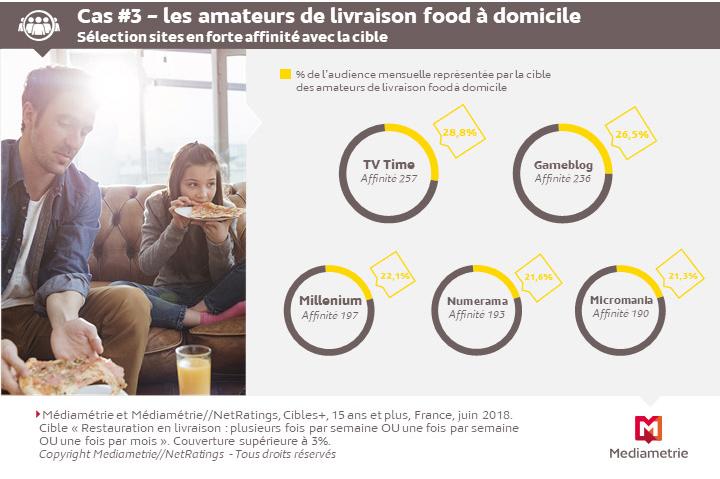

Case Study No. 3 – The new players in food delivery share a booming market. To be seen by these devoted fans, instead of advertising on cookery websites, why not try sites that discuss video and gaming news?

Pour Benoît Cassaigne, Directeur Exécutif des Mesures d’Audience chez Médiamétrie, « contrairement aux catégories socio-démo qui évoluent lentement au gré des recensements de l’INSEE et de la société, [les communautés] sont des groupes instables, fluctuants, fluides ».

To assist agencies and advertisers to target them effectively, Médiamétrie is redesigning its product offering. Beyond the new possibilities of Targets+, Nielsen's Homescan consumer panel will also cross consumer goods purchasing behaviour with the audiences of 6,000 websites. In terms of television, media planning will soon be enriched with intention-based targets, which might be produced for example based on browsing of benchmark internet measurement categories. For even greater campaign customisation, it will also be possible to create clusters based on the queries a web user has typed into search engines and e-commerce sites.

Source: Targets+ Study, France, Base: 15 years and over, June 2018 Copyright Médiamétrie//NetRatings

Contacts:

- Gwenaëlle Rémond, Division Director – gremond@mediametrie.fr

- Rodolphe Desprès, Research and Clientele Manager – rdespres@mediametrie.fr

Test of significance of the differences between two proportions

Used to assess whether the difference between 2 proportions is significant at the 95% threshold

Warning: only applies to a proportion. The Average Rate is an average of proportions and the Audience Share a ratio of proportions. This tool is provided for information purposes. It cannot be applied for professional purposes without further precautions.

des médias

edition

definitions