- Home

- Results & Studies

- Africa : a renewed audiovisual panorama

Africa : a renewed audiovisual panorama

With very few automatic audience measurement, financing of local production is difficult faced with international platforms and channels.

Africans as TV fans

Across the African continent, the population watched TV on average 3 hrs 23 min per day1 in 2017, or 30 minutes more than the worldwide average (2 hrs 56 min). This represents an increase of 10 minutes compared to 2016. This rise is linked in particular to growing consumption of TV in Madagascar, South Africa, Morocco and in Côte d’Ivoire.

Nevertheless, this figure reflects disparities between countries: leaders in TV consumption, the Malagasy people watch television for 4 hrs 34 min per day ; the Cameroonians spend 3 hrs 37 min in front of their TV sets. On the opposite side, only Senegal sees daily usage lower than the worldwide average.

For Arnaud Annebicque, Médiamétrie’s Development Director for Europe and Africa, “In Africa, television is the ultimate mass media, reinforced by a few characteristics specific to the continent, like collective consumption as an example. Television is both an entertainment and an informational medium, valued for its openness to the world.” Its audience brings together a slightly more feminine profile, while sports – especially football – attracts groups.

DTT, the very beginnings of its rollout

In this context, the gradual arrival of DTT to the African continent is opening new perspectives for offerings. Decided during the International Telecommunications Union’s meeting in Geneva in 2006, the digital terrestrial television switchover started in 2015 – with variations across countries – and will be finished by 2020.

Annebicque observes: “For some countries, the digital transition simply represents a technical change, while others are taking full advantage to develop the offering of free channels and thereby remodel their audiovisual landscape.” He continues: “audiences especially expect from DTT a richer, more diversified offering of channels and programmes, with the technical dimension, such as quality or sound, in the background.”

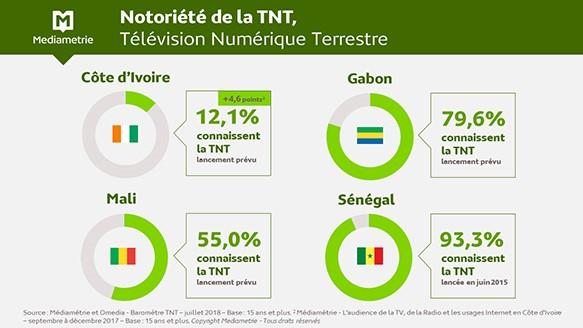

Currently, DTT is being deployed differently from one country to the next. When we talk broadcasting, we’re naturally talking about home receiving equipment. The spread of this equipment is tracked in the context of the DTT barometer in Africa, launched this year by Médiamétrie and Omedia, its partner for Côte d’Ivoire, Gabon, Mali and Senegal. Intended to support the digital transition in Francophone Africa, the barometer measures the perception of the general public towards DTT in each country involved, and its need for digital devices.

In Senegal, where audiences have been receiving the digital terrestrial TV signal for over two years already, awareness of DTT is very high: 93.3% of the population in Dakar know about it.

Côte d’Ivoire initiated its migration to digital at the end of 2016 by granting licenses to four private TV operators; the public audiovisual sector benefits from the possibility of a third channel launching in addition to the two that already exist. In Abidjan, where awareness campaigns have not yet been launched among the general public, only 12.1% of people know about DTT. However, this is an increase by 4.6 points compared to the end of 2017.

The African audiovisual landscape still relies heavily on public service, most often embodied by an evening TV news show that is widely watched. The new private national channels that are appearing in several countries have generally few resources and therefore have difficulties in marketing their advertising space, the only sources of income, which is because advertising markets are still under-invested due to a lack of daily audience measurement. At the moment, only foreign parties – Canal + especially – have the ability to offer attractive content, often pan-African productions, with a pay TV model.

A need for audience measurement

So it becomes clear: the African audiovisual landscape is evolving and opening up to international players. The major international SVoD platforms are gaining a bigger presence on the continent. In this context, Annebicque observes: "We are witnessing the emergence of a more exacting middle class in terms of audiovisual content", especially local content, a phenomenon observed across the world. For this, the new private channels must have the resources to invest in local production, resources they can only obtain through advertising. When we talk advertising market, we’re talking audience measurement. Annebicque continues: "Without audience measurement allowing us to align along international standards, the advertising market is under-funded".

Although TV consumption is high, audience measurement remains relatively poorly developed on the continent. Two countries have taken the lead with automatic, daily TV audience measurement: Morocco via Marocmétrie, a subsidiary of Médiamétrie (see boxed text), and South Africa. Since 2011, Médiamétrie has also conducted reporting-based audience measurements in Senegal, Côte d’Ivoire and in Cameroon, with its partner Omedia, a market and media research company that has a presence in several African nations and that handles surveys and research in about 15 sub-Saharan Francophone African nations.

The research demonstrates that the weight of the TV advertising market in the economy is stimulated by audience measurement. A reliable audience measurement generates increased advertising investments, stimulates households’ consumption and thereby plays a positive role in the economy. Annebicque adds: "By generating additional advertising resources, audience measurement encourages the development of a local production industry, for which Africans are the interested parties – just like in the States themselves."

Considering the investments needed to set up automatic audience measurement, the States have a crucial role to play: first, by helping the market to get organised through professional groups, and also by boosting implementation of an automatic, daily audience measurement.

In Côte d’Ivoire for example, the TV sector’s opening up to competition with the arrival of DTT has led to activating competition between channels, agencies and advertisers and thereby setting off real momentum in the market. Will it be the next African country to set up an automatic audience measurement?

[1] Source : Eurodata TV Worldwide-Médiamétrie

Laure Osmanian Molinero

Next article to come: TV content in Africa, between local production and international platforms

Test of significance of the differences between two proportions

Used to assess whether the difference between 2 proportions is significant at the 95% threshold

Warning: only applies to a proportion. The Average Rate is an average of proportions and the Audience Share a ratio of proportions. This tool is provided for information purposes. It cannot be applied for professional purposes without further precautions.

des médias

edition

definitions